FTX Users To Receive 112% BACK, FTX Claims BILLIONS MORE "Left Over"...

This story somehow never runs out of surprising twists, and this one is massive.

Look back on almost any news coverage, or old posts in online crypto communities made by your average trader - in everyone's mind this was a story about people losing billions. At one point it was probably true, when the market had just been hit with the Terra/Luna collapse There's no downplaying how much this story changes when it no longer involves anyone losing money.

At one point, every FTX user who had funds sitting on the exchange when it shut down believed they had lost money, with many expecting to hear all of it was gone.

Searching old posts in online crypto communities made at the time FTX halted trading show there was little hope they would recover any funds they left in FTX controlled wallets.

Now we finally know how the story ends for the users of FTX - they're getting all of it back, and then some.

FTX Owes $11.2 Billion - All of That and More is Ready to Be Paid Out Immediately...

Under new leadership following FTX’s bankruptcy claim and the arrests of its former executives, liquidation of company assets began. This involved mainly dumping massive amounts of crypto over the last few months, enough where the $11.2 billion owed already sits in US dollars they can access anytime. But there’s more to come, as they claim to still have another $2+ billion in crypto that cannot yet be sold.

Sam participated in a common practice among VCs where projects offer them a chance to invest early by buying coins at an extremely low price. However, these coins are 'locked' and unable to be traded until a future date.

The biggest chunk of FTX's recent windfall of cash comes from Sam's early investment into Solana, where he’s rumored to have paid 0.20 cents per coin - they’re worth $133 each today, but FTX's bankruptcy team supposedly dumped a large amount when it was trading closer to $200.

Solana was the largest source of funds, worth billions, but FTX held millions of dollars worth of dozens of other coins, selling these off totaled several more billion dollars.

The end result - FTX can pay back all users right now, with a little extra.

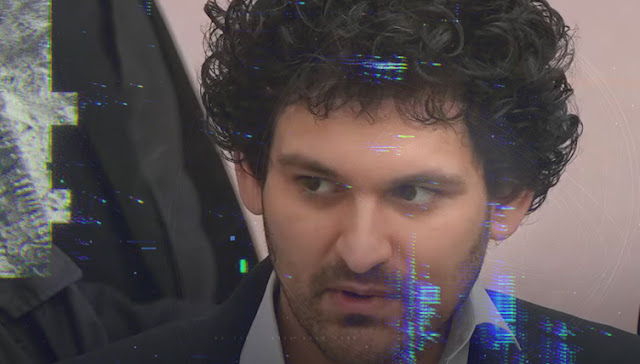

Sam and His Supporters Say This Changes Everything...

According to his family, Sam is in prison wrongly labeled as someone who caused investors to lose billions. Now that the trial and sentencing are done, we learn no one lost anything, and they're even walking away with a small profit - this is a completely different situation than what he was sent to prison for.

32-year-old Sam is serving a sentence of 25 years, the prime of his life wasted - this is a punishment designed for someone who caused countless people to lose their hard earned money.

He'll be 57 when released, that is if he survives prison, as his family says his 'social awkwardness' puts him at high risk of becoming the victim of 'extreme violence' from another inmate confusing Sam's awkwardness for rudeness. His cellmate from the NY jail that held Sam during the trial says there were times other inmates indeed targeted him.

Before Sentencing, The Judge Allowed Some FTX Users To Share Stories of How Their Lives Were Ruined...

At the time, the final outcome was still unknown. These users gave stories of their lives being ruined, stating things like "decades worth of savings" were gone forever because of Sam's actions.

These were the kind of stories the judge heard right before sentencing Sam to 25 years in prison.

It does make you wonder - would the sentence be different if these former FTX users only had stories of their funds being inaccessible, then eventually getting all of it back, with a small profit? Honestly, I have a hard time believing it wouldn't.

But Maybe This Shouldn't Change Anything...

Let's imagine the worst-case scenario. Sam, like everyone else, cannot actually predict the future. While his early investments into projects like Solana are bringing in billions in profits today, things also could have gone the other way.

You can say he made smart investments that paid off, as he knew they would, so from his point of view no user funds were ever at risk. But there's just some things he couldn't have known no matter how much research he put into his decisions. For example, what if Solana faced a massive hack? We've seen hacks ruin projects that had the potential to end up among the top 10 tokens - no one can predict the discovery of a new security vulnerability.

If an unforeseen hack did bring down Solana, this would be a story of FTX billions short on what they owe.

So, while things end with no one losing money, Sam did, in fact, gamble with user funds and expose them to potentially losing all of it.

On that note, while he was risking other people's money, did he plan to share the rewards if it all worked out? Of course not. Sam quietly 'borrowed' user funds without them knowing, he would have taken the profits and return what he had borrowed just as quietly as he took it.

We've all Been Damaged By Sam's Actions...

I was not an FTX user, but that didn't matter as we all watched our portfolios go into a nosedive the day FTX halted trading, and those losses weren't recouped for over a year.

But what many are unaware of is that the damages actually continue to the present day. The reason FTX has so much money right now because they dumped their massive stash of coins on the market over the last year, often at times the market was on the rise, bringing that rise to a halt.

In fact, FTX is the reason why we saw Bitcoin ETFs bringing billions of new investments into the market, and the price of Bitcoin barely move. Sam had purchased shares of Grayscale's Bitcoin Trust which automatically was converted into shares of Grayscale's ETF, so when the ETF went live FTX had 22 million shares of it - which they immediately dumped onto the market.

But it was FTX's Solana holdings that became worth billions while Sam was on trial - there's no way to know what Solana's price would be today if FTX hadn't dumped billions of dollars worth - but higher for sure, possibly much higher.

Fact is - Sam is a Liar...

Ironically, his largest broken promise is in print, on one of Sam's strangest marketing decisions.

The FTX condoms that read “Never breaks...even during large liquidations" - ironically describing the exact conditions that would indeed break FTX.

In Closing...

This is all still sinking in, but when I think about Sam being in prison right now, it feels justified. He deserves some punishment. Where I'm torn is if in 15 or 20 years from now, I'll feel like it's justified that he's still there.

From a legal standpoint, the end result of a crime usually makes a massive difference. For example, imagine someone driving the wrong way on a freeway because they're extremely drunk, and they manage not to kill anyone only because the other drivers swerved to avoid them. Then imagine the same scenario but in this one, the drunk driver kills an innocent driver in a head on collision. Even though we're fully aware that both literally made the exact same poor choices - one could end up in prison for a few months, and the other for decades.

Ultimately, the choices Sam made led him here, making it hard to feel sorry for him now. So while I won't be campaigning to #FreeSam, I also wouldn't be angry to hear Sam's legal team was able to have the sentence re-evaluated, and reduced by a few years.

If you were the judge overseeing the case - what, if anything, would you change given what you know today? We want to know - share your answer with us on X @TheCryptoPress

---------------

Author: Ross Davis

Silicon Valley Newsroom

GCP | Breaking Crypto News